lakewood co sales tax rate

The minimum combined 2022 sales tax rate for Lakewood Colorado is. City of Lakewood Accommodations Tax.

Colorado Sales Tax Rates By City County 2022

Lakewood collects the maximum legal local sales tax.

. 6 rows The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales. The 1025 sales tax rate in Lakewood consists of 6 California state sales tax 025 Los Angeles County sales tax 075 Lakewood tax and 325 Special tax. There is no applicable city tax or special tax.

Lakewood CA Sales Tax Rate The current total local sales tax rate in Lakewood CA is. What is the sales tax rate in Lakewood Washington. 301170 Disposition of Sales and Use Tax Revenue.

The current total local sales tax rate in Lakewood WA is 10000. Groceries and clothing are exempt from the Lakewood and New Jersey state sales taxes. The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax.

The County sales tax rate is. Fountain CO Sales Tax Rate. The County sales tax rate is.

The California sales tax rate is currently. This is the total of state county and city sales tax rates. The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax.

Lower sales tax than 95 of New Mexico localities. The 8 sales tax rate in Lakewood consists of 575 Ohio state sales tax and 225 Cuyahoga County sales tax. The Colorado sales tax rate is currently.

The maximum tax that can be owed is 525 dollars. The December 2020 total local sales tax rate was also 6625. The December 2020 total local sales tax rate was 9900.

You can print a 1025 sales tax table here. There is no applicable city tax or special tax. Lakewood collects a 0.

The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax. Note that in some retail areas of the City a Public Improvement Fee PIF may be charged to reimburse the developer for on-site improvements. City of Lakewood Sales Tax.

Colorado collects a 29 state sales tax rate on the purchase of all vehicles. This is the total of state county and city sales tax rates. The PIF is not a City tax but rather a fee the developerproperty owner requires its tenants to collect.

The Lakewood sales tax rate is. The minimum combined 2022 sales tax rate for Lakewood Colorado is. This is the total of state county and city sales tax rates.

The Belmar Business areas tax rate is 1. Did South Dakota v. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

Sales tax for Lakewood is 3. The minimum combined 2022 sales tax rate for Lakewood Ohio is. This is the total of state county and city sales tax rates.

0875 lower than the maximum sales tax in NY. Portions of Lakewood are part. The Lakewood sales tax rate is.

You can print a 8 sales tax table here. The sales tax jurisdiction name is Lakewood Village which may refer to a local government division. The Lakewood New Jersey sales tax is 700 consisting of 700 New Jersey state sales tax and 000 Lakewood local sales taxesThe local sales tax consists of.

The City will comply with Colorado state law with respect to intercity claims for the recovery of sales and use taxes paid to the wrong taxing jurisdiction The intent and procedure for filing a. N intercity claim for recovery is set forth in the Sales and Use Tax Regulations. State of Colorado Sales Tax.

There is no applicable city tax or special tax. The Lakewood sales tax rate is. 4 rows The current total local sales tax rate in Lakewood CO is 7500.

The minimum combined 2022 sales tax rate for Lakewood California is. 62917 lower than the maximum sales tax in NM. Lakewood collects a 34 local sales tax the maximum local sales tax allowed under Washington law Lakewood has a higher sales tax than 848 of Washingtons other cities and counties Lakewood Washington Sales Tax Exemptions.

The County sales tax rate is. Did South Dakota v. Fountain CO Sales Tax Rate.

You can print a 8 sales tax table here. What is the sales tax rate in Lakewood California. Grand Junction CO Sales Tax Rate.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Lakewood Washington is. 4 rows The current total local sales tax rate in Lakewood CO is 7500.

For tax rates in other cities see Ohio sales taxes by city and county. The 8 sales tax rate in Lakewood consists of 575 Ohio state sales tax and 225 Cuyahoga County sales tax. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax.

The 8 sales tax rate in Lakewood consists of 4 New York state sales tax and 4 Chautauqua County sales tax. The Washington sales tax rate is currently. The December 2020 total.

The Lakewood Sales Tax is collected by the merchant on all qualifying sales made within Lakewood. Avalara provides supported pre-built integration. You can print a 59583 sales tax table here.

Government entities and organizations holding a valid Lakewood Certificate of Exemption may purchase accommodations free of Lakewood sales and accommodations tax.

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Sales Use Tax City Of Lakewood

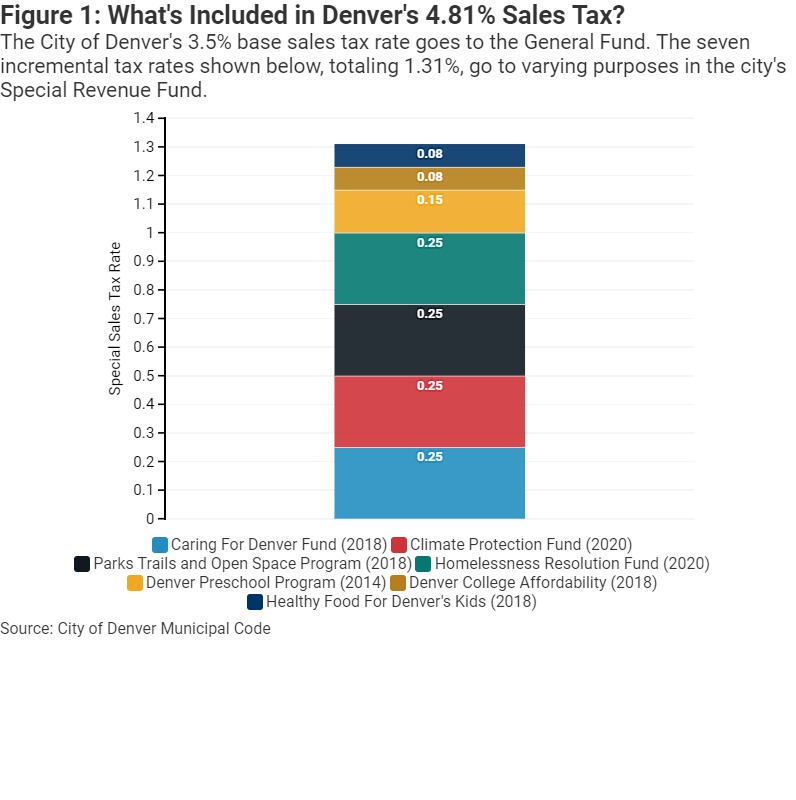

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

How Colorado Taxes Work Auto Dealers Dealr Tax

How Colorado Taxes Work Auto Dealers Dealr Tax

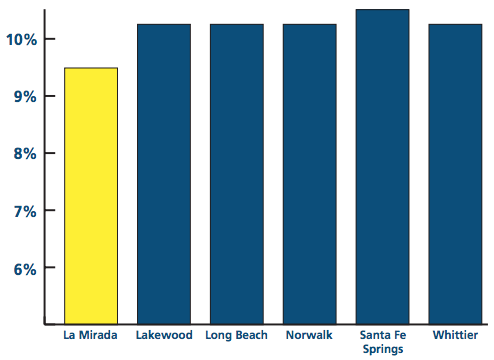

Local Sales Tax Rate Is Lowest In County La Mirada Chamber Of Commerce

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

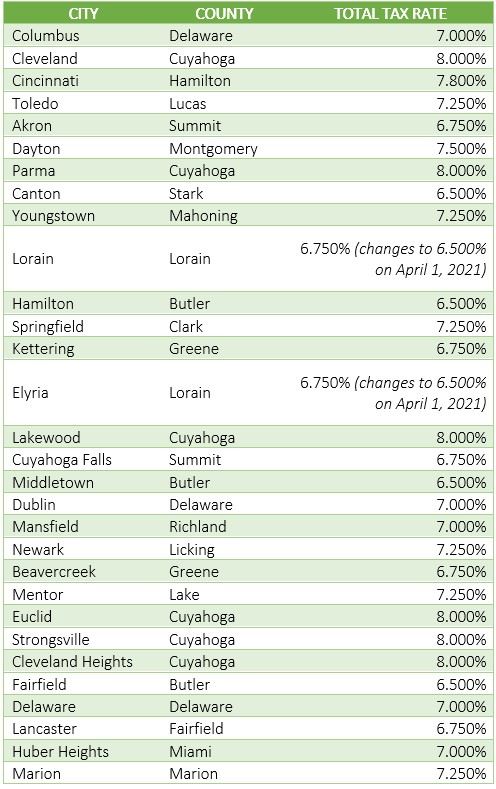

Ohio Sales Tax Guide For Businesses

How Colorado Taxes Work Auto Dealers Dealr Tax

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

Why Do U S Sales Tax Rates Vary So Much

States With Highest And Lowest Sales Tax Rates